Spread Betting Advantages

Financial Spread trading (also known as financial spread betting) allows you to speculate on the outcome of almost any financial market, over a set period of time.

- Advantages of spread betting. The FX market is available 24 hours a day, five days a week. Trading costs are included in our spreads & there among.

- Financial Spread Betting - 7 Advantages: 2015 Football Fantasy Rankings, Tomorrow Football Predictions.

- Such advantages seem to be very attractive for people. Finally, if to compare newcomers that are going to play with spread betting companies, it is not.

- The video discusses the advantages and disadvantages of spread betting and how their implications carry great importance to financial traders.

Strategy and tips for betting point spreads, including game selection, line shopping and key numbers in football point spread betting.

⇑ ⇑ ⇑ ⇑ Listen to Money Talk from the The Motley Fool: David Kuo talks to Robbie Burns about spread betting.

Spread Trading Advantages

There are various advantages to spread trading over traditional share and futures dealing -:

Financial spread trading offers leverage similar to the futures market but with the added advantage of offering traders the opportunity to decide exactly the size of the trade without being limited by fixed contract sizes.

Profits are free of capital gains tax (CGT) under current law. This can make a significant difference to overall trading returns in the longer term. The table below illustrates the tale of two traders. Both commence trading with $10,000 in year 1 and achieve a 40% annual return. Trader Taxman pays CGT at a rate of 50% on all profits while Tax Free Trader uses financial spread trading to make tax free profits.

| Year | Trader Taxman | Tax Free Trader |

| 1 | $10,000 | $10,000 |

| 2 | $12,000 | $14,000 |

| 3 | $14,400 | $19,600 |

| 4 | $17,280 | $38,416 |

| 5 | $20,736 | $53,780 |

| 6 | $24,882 | $75,292 |

| 7 | $29,858 | $105,408 |

Spread betting gains are not subject to capital gains tax. Very simply, if the government started taxing profits made from spread betting, they would have to allow a corresponding tax credit where losses are incurred. But the fact that spread betting providers make money means that HMRC would lose out by taxing spread bet gains. This doesn’t mean there aren’t taxes; the government gets its share by taxing the corporate profits of the providers.

The tax man can keep his grubby paws off your profits as spread betting is tax-free. No stamp duty, no Capital Gains Tax, nothing. Of course tax laws are liable to change but I feel it is unlikely in the near future. Under current laws a recreational spread trader cannot offset trading losses against gains. Simply because an estimated 90% of spread traders lose, the tax office is unlikely to be willing to grant them tax loss deductibility to catch the successful ones.

The ability to choose your contract size. Traditional trading requires minimum dealing commissions or contract sizes. Financial spread trading allows you to determine the size of the stake you would like to trade. For example if you trade the London FTSE 100 index the minimum futures contract size is approximately £10 per point. With one financial spread betting company you could trade the same index as low as a few cents per point.

Spread trades can be made partially on credit. Subject to your experience and financial status, many financial bookmakers will offer you a credit account which can completely eliminate the need to deposit any trading capital. I do not recommend this to beginning traders.

You can close the bet at any time when your spread trading company is open. Some financial bookmakers offer 24 hour trading facilities. The amount you make or lose will then be determined by the current spread quoted, which may be different to when you opened the bet.

Small clients are welcome. A typical stock broker or futures broker is not interested in dealing with small accounts. Indeed, most futures brokers will only deal with a client after they have deposited in excess of £5000 to £10,000 in a broker trust account. Many financial spread trading welcome clients with accounts as small as £50.

Profits can be theoretically limitless and are not set in advance. With spread trading you might bet on the Dow Jones index going higher than 8510, but the higher it goes the more you make with no theoretical upper limit and you can limit your losses with stop losses.

Most financial spread trading companies will allow you to set a stop-loss to limit your potential losses. Without this, your potential losses may exceed your expectations. Stop loss positions can also be guaranteed which is a unique advantage of financial spread trading. Stop losses will be explained in detail later but they offer an ideal way to ensure you do not lose more than you are prepared to whilst you are learning to trade.

When the stock market is sinking, you can be making money. You can go ‘short’ on all available markets, which means you can profit if the price of a market falls. To do this with a normal stock broker can be difficult to arrange and you are usually limited to just a few days, whereas with spread trading you can short stocks or indices for far longer.

No stamp duty or commission is payable on spread trades. All costs are incorporated into the spread.

Spread Betting Advantages Definition

Trade multiple markets on one account. Financial spread betting companies offer a one stop facility to trade a diverse range of financial products across the world you wouldn’t otherwise have access to and profit from situations at all corners of the globe. These include currencies, options, interest rates, commodities, stocks and more. In fact, it is now possible to trade a huge array of global instruments, 24 hours a day, using your financial spread betting account.

You have leveraged access to these markets, meaning you can invest more with less outlay. Spread-betting can be an amazing adrenaline rush when you see the market moving massively in your direction. Who thought financial markets could be exciting! Beware however that the value of your investment can rise as well as fall!

With spreadbetting you will be in charge of your own investments, rather than relying on a third party with questionable motives.

Spread Trading Disadvantages

Spread betting is not without risk and you could be risking more than your initial deposit. There are some downsides to consider and understand before you begin trading. There are also various disadvantages to spread betting that you should be aware of:

You don’t actually hold any assets when spread betting. To most people this is not a concern as it is all about the profits you can make.

Spread Betting Advantages Against

Losses could be higher than with traditional share trading however it bears a similar risk profile to futures trading. This means that if you are careless you could lose thousands more than your initial deposit if things go drastically against you. If you set your stop losses sensibly you can prevent this from happening to you. And if you want to be absolutely safe you could trade with a provider like Ayondo who have a policy of not enforcing negative balances.

If you enjoy day-trading it can be very time consuming as you will be spending a lot of time looking for correct exit and entry points. However, you can set an order to open so your trade will open at a specified level and also you can set a limit order to close your trade when the markets hit a certain level thus locking in your profits. This allows you to spend much less time monitoring your positions if you have to go to work.

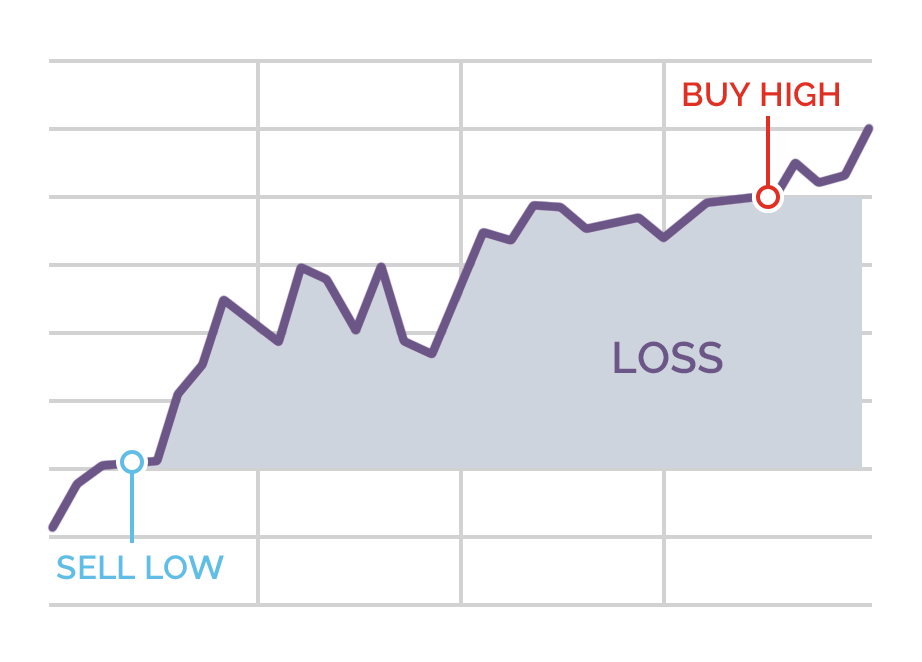

It is easy to get carried away and begin to trade emotionally. Remember to cut your losses and use logic to trade not emotions.

Holding spread bets for long periods of time can be more expensive than traditional sources of financial leverage. You still have to pay commissions to the firms thru the price of the spread and charges for rolling your trades overnight so it is not fully commission-free. Although this is a fraction of what you will have to pay when using traditional investments…

If you make a loss you cannot offset this against capital gains tax you owe for other investments.

Financial spread betting companies are able to change the spreads, margins and markets available at very short notice. This can limit profits or create larger losses than would otherwise have been the case. Due to the competitive nature of the financial spread trading industry, most spread trading companies provide a high level of service.